Sea-Intelligence: NAWC Volumes: Market Dynamics in 2025-Q4

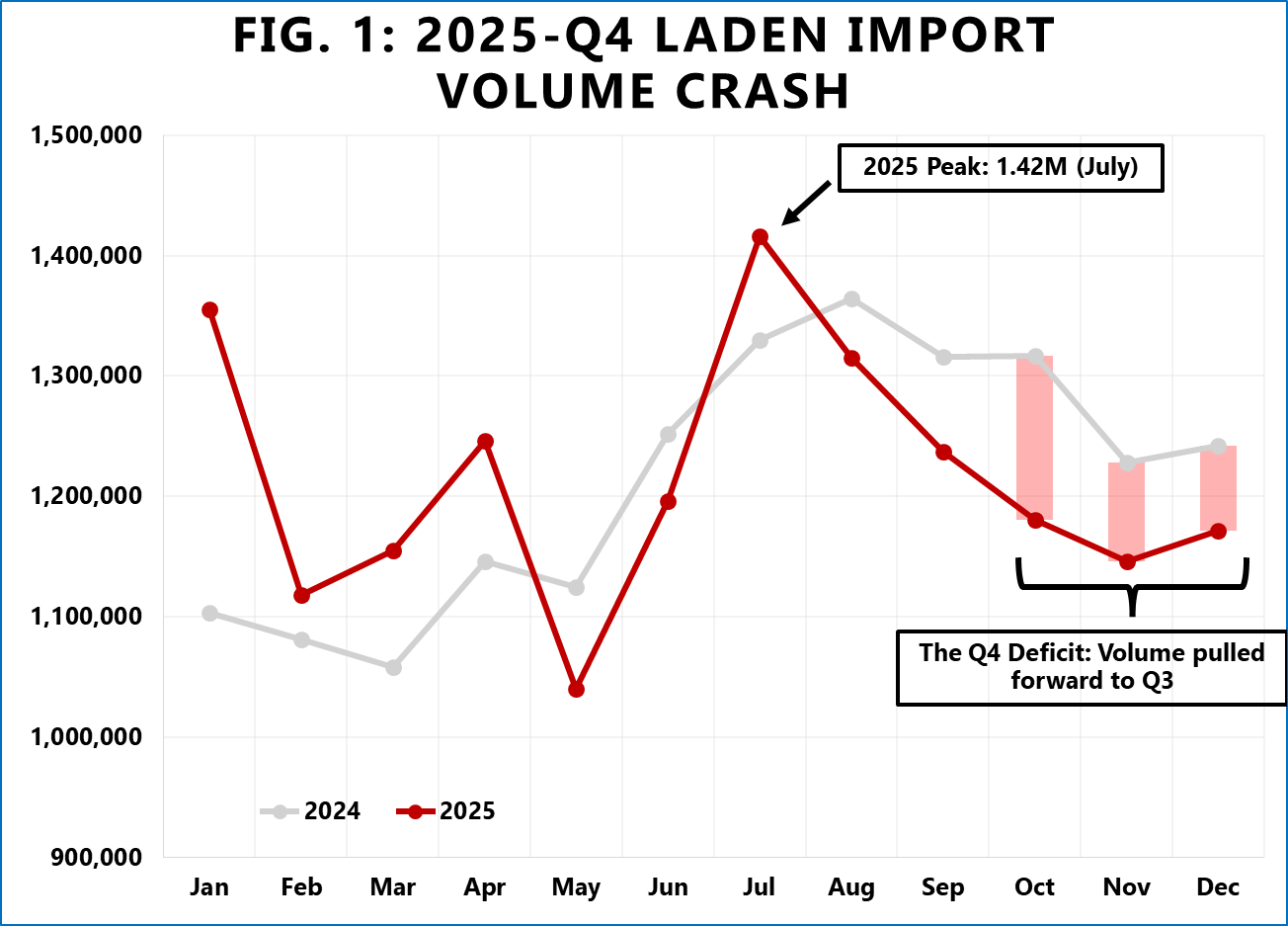

Figure 1 illustrates this shift in seasonal volume distribution. In 2025, total laden imports peaked early in July at 1.42 million TEU – the highest single month of activity since May 2021. This peak occurred a full month earlier than in 2024, driven by shippers accelerating cargo import to mitigate perceived end‑year supply chain risks. However, the subsequent slowdown reveals that this early surge effectively borrowed demand from the future.

In 2024, volumes remained resilient throughout Q4, with October levels holding steady against the August peak. In stark contrast, 2025 saw a rapid deterioration. By October 2025, volumes had dropped to 1.18 million TEU, a massive reduction of roughly 236,000 TEU from the seasonal high, dropping even further to 1.15M TEU in November. On a Y/Y basis, October 2025 laden imports were -10.4% lower than in October 2024, while November was down ‑6.7% Y/Y. Overall, 2025-Q4 was down ‑7.6% Y/Y.

Outside of the volatile pandemic years, 2025-Q4 has seen the sharpest Q4 Q/Q volume contraction in the 2013-2025 period. Furthermore, it is only the second time in over a decade (the other being 2019) that Q4 volumes have contracted on a Y/Y basis.

These volume figures indicate that the high volumes seen in the summer of 2025 were not driven by organic consumption growth. Instead, they were the result of a strategic acceleration that exhausted seasonal demand early, leaving ports with a significant volume deficit to close out the year.

The post Sea-Intelligence: NAWC Volumes: Market Dynamics in 2025-Q4 appeared first on Container News.

Content Original Link:

" target="_blank">